Courtesy NWCCOG nwc.cog.co.us

Opportunity is knocking in Vail real estate market - but when do we let it in?

July 7, 2008 —

How do you know when there’s a housing bubble? The numbers never lie: from 1998 to 2004, the average home value in Eagle County increased 76 percent to $554,000, while the national average increase over that same period was 18 percent, to $96,700.

You know the bubble has burst when, as as David O. Williams reports this week, sales in Eagle County are off by 50 percent, and most of those sales were Arrabelle deals inked years ago, which closed in May, distorting the numbers.

We’re on the proverbial roller-coaster ride, and though we know the numbers must one day come back up, that doesn’t make the plunge downward any less stomach-churning for the people of this Valley who rely heavily on the Real Estate industry.

In this Valley, that’s almost everyone. Real Estate related business accounts for roughly 60 percent of Eagle County’s economy, according to the Northwest Colorado Council of Governments (the same institution which provided the numbers atop this blog.) Another huge chunk comes from commercial and residential construction, which certainly feels the shockwaves of the kind of economic strain now being felt in the Vail Valley – as well as nationwide.

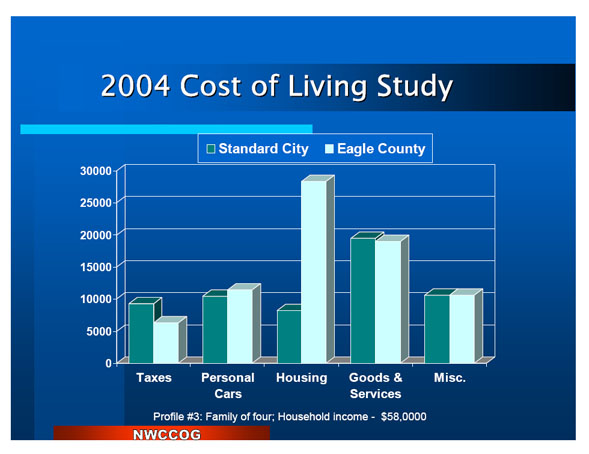

As our market corrects itself, it may also be correcting another problem: labor. The demand for labor in Eagle County was anticipated to far outreach supply when the NWCCOG studied this county’s labor force in 2004. Simultaneously, our cost of living was reaching an untenable situation – not because the cost of groceries, which are now comparable to a “Standard American City,” but specifically because of the cost of housing, which was four times that of the “Standard American City” in NWCCOGs 2004 study.

Barring an absolute collapse of the American economy (a far-fetched scenario no matter what the cable news networks seem to imply) our slowing real estate market is simply the effect of the so-called “invisible hand” of a free market making a much-needed correction. Housing should become more affordable for laborers, while at the same time demand for labor should decrease as our economy slows down.

Waiting in the wings are plenty of people with considerable buying power. When the time is right, and the market has made its corrections, they will begin to snatch up the smokin’ deals which are even now available throughout the Valley.

Sellers once hoped to turnover their property for $75,000 or $100,000 after two years of ownership. They must now realize their prices must come down. Once they do, the wheels of our Valley's economy will begin to churn again, our market will recover, our homes and properties will assume their true value, and we can slowly, and sensibly, grow that value over the course of the coming years.

In the meantime, opportunity is knocking for those with a bit of capital. If ever one wanted to become a Real Estate mogul in Vail, the time is nigh. As so often is the case, it's only a matter of money and timing.

![]() Comment on "Opportunity is knocking in Vail real estate market - but when do we let it in?" using the form below

Comment on "Opportunity is knocking in Vail real estate market - but when do we let it in?" using the form below