- An attempt to bring 'Colorado common sense' in Congress from Senator Michael Bennet

- A call for stories of Vail's ghosts and haunted houses

- Was it an alien ship, a UFO, or God who evaporated Air France flight 447?

- Part II: Large Hadron Collider will likely spell end to String Theory

- Part I: Don't expect CERN's Large Hadron Collider to reveal new dimensions of space and time

- Vail Mountaineer vs. Vail Daily Starbucks-gate: no wonder newspapers are dying

- Report: Hasan's moderate views catch conservative confab off-guard in D.C.

- The presidential politics of skiing: Did snow sports get the right guy?

- Happy New Year … but wait a second: scientists turn back time in 2008

- Happy trails to the valley's greatest weekly paper: The Vail Trail

- All Real Rhetoric Articles

September 27, 2008 — Middle-class America is wiped out of savings, can’t get credit, and no immediate relief is in sight. Many economists today are saying that the current middle income class of America is in the worst shape it has been since the last recession in 2001. Perhaps even worse off.

And now with a $700 billion corporate bailout being paraded around the Hill, it doesn’t seem likely that the middle class could possibly get relief. Not so, say Sen. Barack Obama's top economic advisers.

Energy, food, gas, health care and daily expenses have gone up. Credit lending is frozen. Savings has been exhausted as households try to keep up with expenses but wages have stayed stagnant. Economists are still arguing exactly why this is happening even as the economy has enjoyed gradual growth since 2001. Some say American apathy and less productivity are to blame.

Others blame globalization and the widening wage gap between countries and markets. Despite the cause, the reality is that the American middle class is 46 percent of the working class and the most likely to affect basic principles of supply and demand. By providing economic stimulus the government would provide a jolt to the largest sector of consumer confidence and spending while allowing the majority of consumer savings to re-accumulate.

Some are quick to point out, however, that the U.S. government has handed out two rounds of economic stimulus in recent months in the forms of tax breaks and tax refunds. Those arguably did not work, or perhaps, to further the argument, they have only gotten us this far. Regardless, the U.S. middle class is still stuck and looking down a long barrel of spending before it sees another luxury dime.

A previous congressional bill was passed earlier in September in response to Freddie Mac and Fannie Mae to assist the mortgage crisis. Another congressional spending package was passed four months ago to assist homeowners who could not afford their home payments; it promised federal assistance. Still nothing newsworthy has come from those legislative bills.

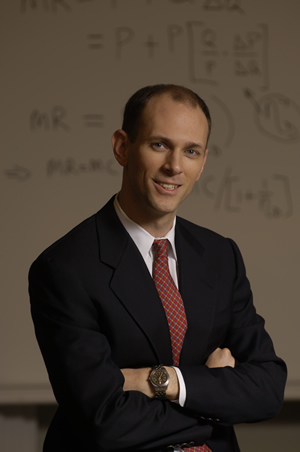

Obama’s lead economic adviser, Austan Goolsbee, explained why the middle class requires tax breaks in addition to the $700 billion corporate bailout at a speech Thursday night at Reed College in Portland, Ore. Professor Goolsbee is the Robert P. Gwinn Professor of Economics at the University of Chicago Graduate School of Business. He has been working with Obama since his early U.S. senate campaign in Illinois and currently serves as the presidential candidate’s lead economic adviser.

At Reed, Goolsbee highlighted just how unbelievably complicated and intertwined the consumer credit, mortgage, securities, and banking industries are. But he also reassuringly offered his belief the American financial system will not completely fall apart.

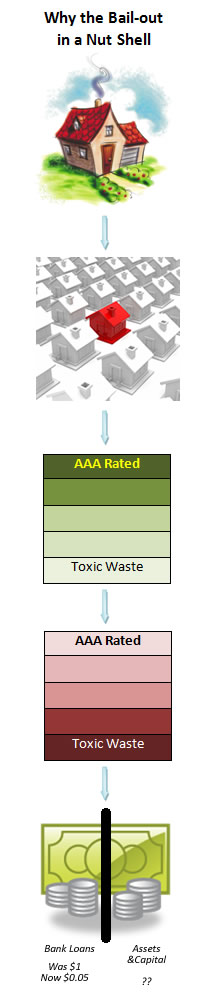

Elementary Pictionary of a Mortgage crisis

Paraphrasing a bit of Goolsbee’s chalk-boarding skills and implementing elementary Pictionary of today’s mortgage and financial crisis, the explanation of where the bailout might be used sheds light on the symbiotic relationship between the bail-out and tax relief. Make no mistake about any of this, it is and always has been a very risky proposition.

Consider your neighbor who stretched his wallet and agreed to a below prime adjustable rate mortgage that was too good to be true. Let’s call him Bob. Bob thought his wage and home values would continue to grow above inflation. Bob knew it might be a stretch, but he had a little savings and the current state of the American credit market allowed him to stretch.

The banks and creditors produced creative products that allowed consumers such as Bob to buy a home. Some might say that these people, such as Bob, should have never been able to purchase a home and that the credit market should have never offered such creative products. Perhaps in hindsight this is true; certainly not at prices offered so far below prime at adjustable market rates.

But remember, we are talking about Bob here, your neighbor. Every American should be allowed the chance to own their home, and the resilience of the American economy since 2003 or 2004 allowed many to do so. The credit-based American economy is based on lending money, and the more people we can lend to the stronger the economy, even if we lend to those who may default on their credit. At least that is what some of these banks thought.

Bob’s mortgage was lumped together with tens of thousands of other sub-prime mortgages and grouped into what are called mortgage-based securities (MBSs). Banks grouped all of these sub-prime mortgages and started selling them as mutual-fund-like stocks. They knew that some of Bob’s friends would not be able to pay or would be late on some of their payments. But they also knew that Bob more than likely would survive and pay.

The banks then leveraged these three principles: 1. Banks would own the properties if they were defaulted; 2. They could pretty much guarantee that most people like Bob would at least meet their interest payments; and 3. They figured out a way to pass the unrecoverable liability to the next highest bidder.

The mortgage liabilities were passed on through long-standing, yet still creative, products called Collateralized Debt Obligations(CDOs). CDOs are an unregulated asset-backed security and credit product. These CDOs were not new products except in volume and value. CDOs were outside of the federal regulatory system and could not be legally watched by the Fed or by the SEC. They were bound by market pressure and the capitalistic dogma that the market will take care of any wrong doing.

The CDOs riskily absorbed most of the industry-named “toxic waste,” or the bottom tier of sub-prime loan liabilities within the MBSs and CDOs. That’s right, even the industry dubs these accounts as toxic waste! These toxic waste CDOs then in turn branched out again, grouping the worst CDO assets into squared and cubed CDOs of the bottom tiers. This essentially grouped the trash of the banking and credit markets in toxic waste CDOs that no one wanted.

A traditional bank owns assets that can be borrowed against. The bank owns cash and then lends that cash and credit based on assets. For every dollar the bank owns in accredited assets, the Fed allows them to lend X amount more. In the early stages of the sub-prime lending, banks had lots of cash on hand and were allowed to lend more. As the housing bubble popped in major markets like California nearly two years ago, the housing values across the United States began to fall, loans defaulted and losses in other markets occurred, causing banks to hastily refinance where they could and hold their breath.

The Fed allows overnight bank trading called “repo” loans. This procedure allows one bank to loan another bank overnight based on the Fed bank lending rate. For many, many years banks have floated their costs knowing that tomorrow the deal would be closed. Recently banks hit that wall where the deal didn’t close.

The bank then looks for another lender, hopefully local - maybe abroad, until the bank becomes too risky and no one is willing to make a loan. Even the Fed offered an emergency borrowing fund at extremely high interest rates that some banks ignored or just passed up because those rates were too expensive. The United States of America financial institutions are no longer lending, borrowing, or issuing credit across the market at the “normal rate,” and most “repo” loans have stopped all together.

Who owns what and what is the liability?

Along with big banks, investment banks used to hold most of this liability, but they no longer exist. Investment banks recently accepted the olive branch by the U.S. government to quickly switch their corporate status to bank holding companies. Guess who owned the most of the toxic waste CDOs? Bear Stearns. Guess who held the second most? Lehman Brothers. Guess who owned the third most toxic waste? Merrill Lynch. And on and on … Only banks and bank holding companies are within the “regulatory” lingo that is being passed around in the bailout talk.

Enter another giant American company: AIG. Guess who insured most of the toxic waste loans? Sure, AIG expected the banks to be able to pay those premiums when they issued the insurance. Of course they would. But when the top banks started going down, AIG realized they had an immediate cash-on-hand problem.

When the banks that had purchased that insurance called the insurance in, AIG didn’t have the cash on hand. AIG has plenty of assets, but not the cash. It would be as if AIG was a millionaire in Vail needing to liquidate his assets tomorrow. He has the wealth, but not the cash.

So now we have the U.S. government owning 80 percent of AIG, essentially creating a nationalized insurance agency. The intended U.S. government plan is to sell AIG back to free market when the markets return to normal competition. But for now the thought of national insurance is baffling and potentially an amazing asset for the American taxpayer.

As these “banks” try to act as traditional banks and as markets correct themselves, the U.S government is fundamentally trying to prevent an early 20th-century-like bank run from occurring in the 21st Century. According to Professor Goolsbee, Warren Buffet himself has assigned the top two inventions in the 20th century to penicillin and to the Federal Deposit Insurance Corporation (FDIC).

The richest man in the world might have a good point if you try to imagine the current fiscal crisis without it. Today with government FDIC backing, we know that up to $100,000 of our own money will be there even after the bank doors close.

Now we are faced with the 21st-century bank run, which is outside of the federal government’s jurisdiction and is not being regulated. The mortgage holdings by “banks” are not currently insured by the government if they ultimately fail.

In the olden days, when the largest bank failure in history like Washington Mutual strikes, we would have many folks barn storming to bank doors to get their money and passing that burden to other banks. In fact, WaMu reportedly had more than $16 billion of cash deposits reclaimed in the last month.

WaMu was known as a bank for the working class and the middle class but had heavily leveraged itself on mortgages and its holdings. JP Morgan Chase’s acquisition of WaMu after government takeover is an indicator of the government’s willingness to find deals and make them happen quickly. More than likely on the tax payer’s behalf.

To prevent the modern day 21st-century bank run on mortgages, MBSs and CDOs, as well as rekindle the overnight lending market between bank holding companies, the bailout deal should include federally insured mortgage insurance for holding companies and banks. As long as the deal includes equity for the taxpayers in any company the U.S. government bails out, it should be a good investment. The U.S. taxpayer has an opportunity to invest in the future now, or incur a slow and long economic crawl for several years.

But how can the U.S. government bail-out corporations that have systematically muddled the global financial economy and still hand out an economic stimulus through tax breaks?

Sen. Obama’s campaign reiterated what Sen. Obama said himself on Friday during the presidential debates that a review of the upcoming fiscal budget is necessary to determine how the nation will pay for the bailout.

Programs will need to be reviewed and some things will need to be cut back immediately and hopefully funded later. What those programs are will be determined by how quickly the U.S. fiscal economy recovers and how quickly the assets acquired by government investment return to higher than market value and liquidity is returned to the financial markets.

The $700 billion bailout could be considered a quick-turn loan since the congressional Democrats are demanding equity of the banks that the government will be bailing out on behalf of the American taxpayer. Similar bailout plans during the Great Depression and after World War II actually made the taxpayer money.

The government now owns 80 percent of AIG, essentially creating a nationalized insurance agency. President Bush wanted to write Secretary Paulson a blank check for $700 billion that had no oversight and no regulation.

Goolsbee understood, during his lecture at Reed College, why this demand was made and why in the short term it makes sense. But Goolsbee also acknowledged that without ANY oversight Paulson might as well give it to his mother.

The markets are just too crazy. The $700 billion hopefully reinvigorates the market for bank lending and credit lending; and purchases the toxic waste mortgages that are deemed totally worthless to hold them for a day of greater value. The bailout allows for banks to issue “repo” loans again.

By stimulating the internal bank lending market and by getting rid of the worst mortgages, the banking industry can recharge and start lending each other money again, in turn lending that money to the middle class for house improvements, education, and business.

Obama’s campaign should demand ownership of the toxic waste mortgages and equity within the companies that hold them. The Obama campaign is also suggesting that Paulson does not buy the toxic waste mortgages at below market value, like he wants to, but at current or higher market value. This allows relief to the MBSs and CDOs but not total bailout.

Purchasing the mortgage bank securities and high-risk CDOs at a low rate and selling them in the future at an equal or higher return is a way for the $700 billion to pay itself back. The bailout package could be effectively financed over three to four years and should be credited to foreign lenders and will not require tax increases.

The bailout package will pay itself back so long as there is not a total economic collapse and the vested interests in major U.S. financial institutions does not desolve.

The American taxpayer benefit

The U.S. government is the only bank/institution that is capable of absorbing the major losses of capital and holding them until the losses appreciate and the market returns with liquidity. The banks and holding companies are so near insolvency that no one but the U.S. government will lend them money -- money that will be paid back and financed over several years and not require middle-class tax increases, but instead relief and future dividends.

The immediate short fall of cash for this plan to bail out the banks and insure the mortgages will be held as credit against the American taxpayer. The American middle class is the largest tax-paying bracket and will feel the largest burden. Where the credit goes is the major question – to the trillion dollar debt or to a foreign investor. In true form of the American economy, we’ll end up borrowing the money again against what we promise to pay in the future.

By giving the middle-class tax relief or economic stimulus, a core group of the U.S. economy with kick-start the credit lending from the bottom up. It increases consumer spending and confidence. Since the bailout works from the top down, somewhere right in the middle is where the U.S. economy will again find that sweet spot.

![]() 3 Comments on "An elementary explanation of the symbiotic relationship between tax relief and bailout"

3 Comments on "An elementary explanation of the symbiotic relationship between tax relief and bailout"

Renee Boyd — September 28, 2008

I am a CPA and this article is a great read to remind and or educate why we are even dealing with this economic and financial pandemonium in the first place that now, only the government can attempt to fix.

I have been spending my freetime reading and watching the news on the economic situation we are currently in with our financial markets, but find that the root cause of the need for a $700 billion bailout by the government often gets muddled in the financial jargon.

One additional point worth mentioning is the effect of the accounting rule ‘mark to market.’ Companies, including banks, are required to mark their assets down to market value or the value that a buyer would pay for the asset at any given time. When there is no buyer, the asset must be valued at $0 or close to. This directly affects the amount the bank can borrow from the Fed which is ultimately the banks liquidity or cash it uses to operate on a daily basis. When the assets have been written down significantly which is happening in today’s market, the banks do not have access to the cash needed.

Interesting world we are living in and thanks for the elementary explanation on a topic that is confusing to many.

chris grammmar — October 12, 2008

The American middle class is the largest tax-paying bracket and will feel the largest burden. This is not true. The majority of taxes are paid by the wealthy. The top 1% of tax payers pay over 50% of taxes. Secondly when a middle class friend of mine got her welfare check oh excuse me stimulus check she took the kids to Disney Land. She did not save or invest it. The middle class has seen an enormous increase in their wages in increased allocations for worker's compensation, and health care they have not seen however an increase in disposable income because of these mandates/entitlements. That is where you can bring the bacon home to the working class by reforming these.

Kent Van Vleet — October 17, 2008

By population and sheer number the middle class represents the largest sector of American tax-payers. They will also feel the largest burden because there are more people in that class. The top 1% will not feel a "burden" the same way a strapped middle class family would. Your friend who took the stimulus check to Disneyland did exactly what the stimulus program was designed to do. Create spending and go shopping as W. had intended. Had she saved or savings = invested she would have lost almost 45% at this point.

The idea behind an additional Stimulus is to offer more disposable income to kick start the economy and reinvigorate the credit market. Not save. Stimulus is meant to be disposed into the ether of the U.S. economy.

Thanks for your comments Renee and Chris!